Insurance Solutions Built for Agriculture and Business

The Trusted InsurancE Partner for Farms, Ranches, and Businesses

Providing reliable coverage solutions for agricultural and commercial operations across multiple states.

Protecting Farmers, Ranchers, and Businesses Across the Region

Insurance Solutions You Can Trust

At MFI Agency, we help protect what matters most to you. We specialize in farm, ranch, agribusiness, and commercial insurance, built with firsthand knowledge of your industry.

Located in Greenville, Texas, and licensed in multiple states, we offer straightforward solutions with proactive service and dependable support. Whether you’re a family farmer, small business owner, or large operator, we are here to help secure your future.

Trust By Clients

Recognized across Google and Facebook for excellent service and client satisfaction.

We're Proud Members of

Expertise Backed by Real Farming and Business Knowledge

Why Farmers, Ranchers, and Business Owners Choose MFI

Choosing the right insurance partner matters. At MFI Agency, we combine firsthand farming knowledge with commercial expertise to deliver protection that fits your operation. Our team is committed to clear communication, proactive service, and finding the right solutions no matter how unique your needs are.

Agricultural Expertise

Our founder’s farming background ensures we understand your world.

Customized Coverage

We design insurance options to fit farms, ranches, and businesses.

Proactive Service

We review your coverage regularly, so you stay protected.

Insurance That Reaches You

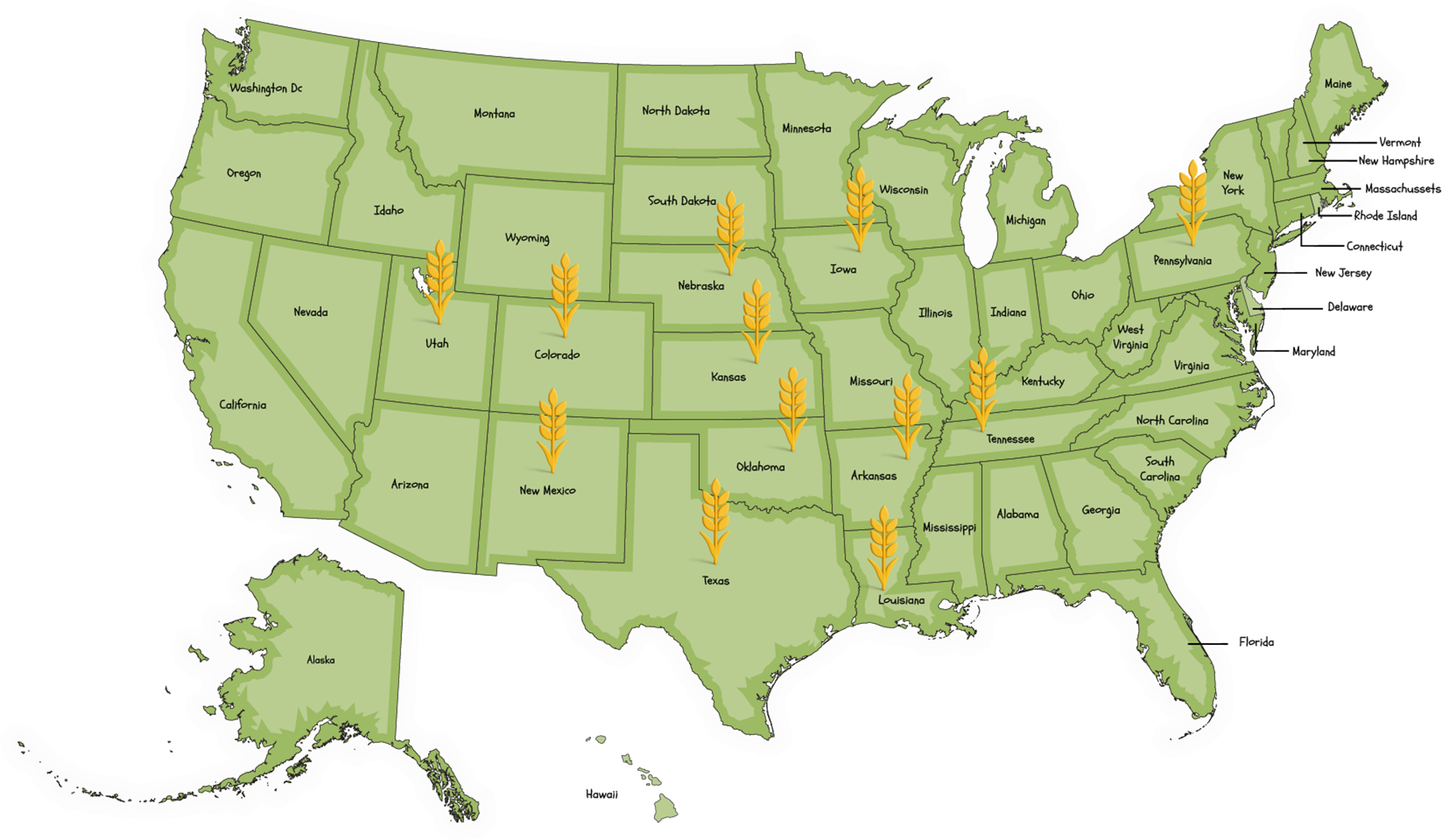

Serving 12 States with a Proven Process

MFI Agency proudly serves agricultural and commercial operations in twelve states. Whether you're managing a ranch in Texas or running a distribution hub in Pennsylvania, our process ensures you receive insurance that fits your needs and grows with your business. We're licensed and ready to help in the areas where food, farming, and industry drive local economies.

Discover

We take the time to understand your operations and discover gaps and exposures.

Align

We search the market for the carrier that best aligns with your budget and coverage needs.

Deliver

We deliver the best proposal and explain how it protects your operation.

Sustain

We proactively check on you as your business evolves.

Real people who care about your success.

Meet the MFI Agency Team

At MFI Agency, our team brings industry knowledge, farming experience, and a deep commitment to client service. Every policy we write is backed by people who genuinely care about helping you protect your land, your business, and your future. When you work with us, you're working with professionals who know your needs and show up with solutions.

Protection Built for Business Operations

Commercial Insurance Solutions

At MFI Agency, we deliver commercial insurance options designed to help businesses stay protected against common risks and unexpected challenges. Our coverages provide financial security so you can focus on growing your operation with confidence.

General Liability Insurance

Protect your business from claims of bodily injury, property damage, and personal injury.

Commercial Auto Insurance

Insure your trucks, trailers, and vehicles used for business purposes.

Commercial Umbrella Insurance

Extend your liability protection beyond the limits of your existing policies.

Excess Liability Insurance

Extra coverage to help protect your business from large, unexpected claims.

Experience and solutions tailored to your field.

Focused Protection for Specialized Industries

Every industry faces unique risks. At MFI Agency, we focus on industries that require specialized knowledge and strategic coverage. From traditional farming to agricultural innovation, we help protect the operations that feed, grow, and build our communities.

Farms

Read More

GET INSURED NOW!Protecting row crop farms, dairies, and aquaculture facilities with tailored insurance solutions.

Ranches

Read More

GET INSURED NOW!Coverage for cattle operations and livestock businesses to safeguard your livelihood.

Ag Suppliers

Read More

GET INSURED NOW!Insurance for feed mills, grain elevators, and input suppliers supporting agriculture.

Food Processors

Read More

GET INSURED NOW!Customized protection for commercial kitchens, processors, and manufacturers.

Food Distributors

Read More

GET INSURED NOW!Coverage for fleets, warehouses, and distribution networks moving products safely.

Retail/Foodservice

Read More

GET INSURED NOW!Insurance solutions for independently owned restaurants, cafes, and small food service operations.

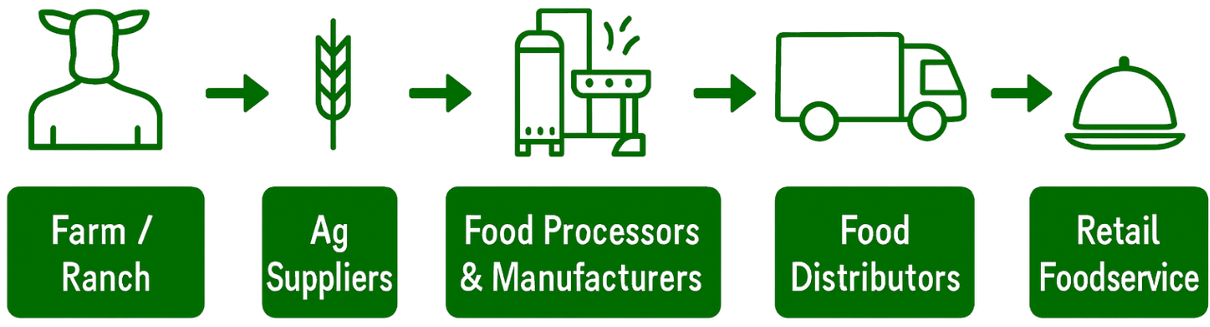

Focused on the Entire Food Supply Chain

Who We Serve in Food & Agribusiness

MFI Agency understands the unique risks and coverage needs across the food and agriculture industry. Whether you’re growing crops, producing packaged goods, or distributing across state lines, we offer insurance solutions designed for every part of the supply chain.

400+

Clients Protected

15+

Years of Insurance and Ag Experience

150+

5-Star Client Reviews

Your Path to Better Protection

How to Get Started with MFI Agency

Getting the right insurance doesn’t have to be complicated. At MFI Agency, we follow a straightforward process to understand your needs and match you with the right coverage. Whether you’re insuring a ranch, agribusiness, or commercial operation, we’re here to guide you every step of the way.

FAQs About Our Services

Answers to Common Insurance Questions

Providing clarity on coverage and policies.

How does equipment breakdown insurance work for farms?

Equipment breakdown insurance provides coverage for unexpected mechanical or electrical failures of essential farm equipment. This includes machinery like irrigation systems, refrigeration units, and milking machines. Such coverage helps mitigate repair or replacement costs that aren't typically covered under standard property insurance.

For instance, if a power surge damages your grain dryer, equipment breakdown insurance can cover the repair expenses and any associated income loss due to downtime. This ensures that your farming operations can resume promptly without significant financial setbacks.

Can I get replacement cost coverage on tractors and farm equipment?

Yes, many insurance providers offer replacement cost coverage for tractors and farm machinery. This type of coverage reimburses you for the cost of replacing damaged equipment with new items of similar kind and quality, without deducting for depreciation.

For example, if your tractor is destroyed in a fire, replacement cost coverage would cover the expense of purchasing a new tractor of comparable specifications. It's important to note that eligibility for this coverage often depends on the age and condition of the equipment.

Do I need farm insurance if I am a hobby farmer?

Absolutely. Even if your farming activities are part-time or not your primary income source, hobby farm insurance is crucial. Standard homeowners insurance policies typically exclude coverage for farming operations, which means structures like barns or equipment like tractors may not be protected.

Hobby farm insurance provides tailored coverage for your unique needs, including protection for outbuildings, equipment, and liability risks. Whether you're selling produce at a local market or simply maintaining a small flock of chickens, this insurance ensures that your assets and activities are adequately covered.

We are licensed in Arkansas, Colorado, Iowa, Kansas, Oklahoma, Tennessee, Texas, Pennsylvania, and Utah.

Protecting the food supply chain.

Helpful Insights for Farmers and Business Owners

Latest Articles from MFI Agency

At MFI Agency, we believe informed clients make better decisions. Our blog shares practical tips on farm and business insurance, industry updates, and strategies to help protect what you’ve built. Whether you're managing crops, equipment, or employees — we’ve got helpful content to guide you.

Is Your Farm Truck Covered Off-Road? What Texas Farmers Need to Know About Commercial Auto Insurance

Growing People, Not Just Policies

Our Commitment to Community Through AgriStart Farm

MFI Agency proudly supports and operates AgriStart Farm, a nonprofit organization dedicated to community growth, education, and access to agriculture. Through this initiative, we invest in rural development, support local food systems, and mentor aspiring farmers. It’s our way of giving back to the people and places that shape our work every day.